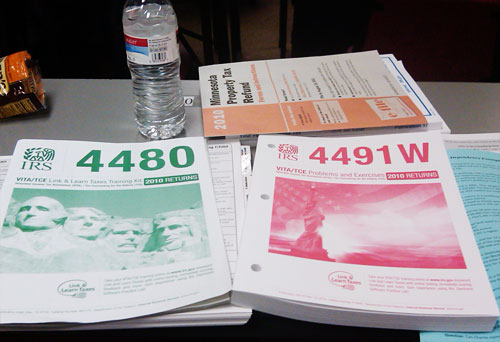

It’s 8:40pm. I am in a classroom full of accountants and professional tax preparers. An IRS agent is two seats down.

This isn’t going well. My numbers on TaxWise are wrong. The forms won’t link. I didn’t depreciate a computer correctly. Another number won’t show up on the Schedule C.

The trainer says, “The number is $7,531. Everyone got that? Yes? Raise your hand if you don’t.”

I’m the only one. The accountant next to be giggles.

This was my fourth 3-hour training session at the tax preparation nonprofit. I have learned two things so far:

- Tax law classes are not the same thing as tax preparation courses.

- I need to study Schedule C more.

The intense 3-hour sessions, practice tests, and impending IRS certification tests mean that I am learning quickly. The wrong numbers on my computer screen mean that I haven’t learned quickly enough. Hopefully I’ll figure this out before the start of tax season.

3 Comments

Mike

February 4, 2012 at 4:43 amThanks for sharing! Check out my website for tax help!

Andrew

February 4, 2012 at 4:44 amGreat post! Thank you for sharing!

David

February 4, 2012 at 5:13 amThanks for sharing! Check out my blog for tax help!