I only had one question for the IRS:

I call the IRS’ practitioner priority line. Hold for about 30 minutes. Get transferred.

I hold for 10 more minutes. Get transferred again.

Reach a third person who gives me a number.

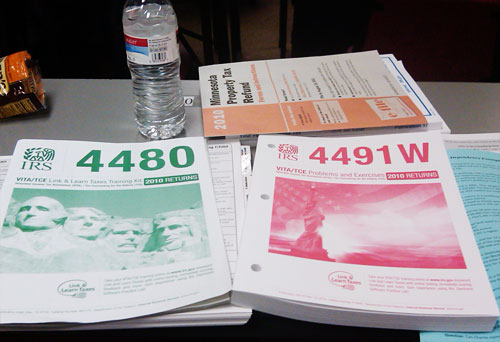

It’s 8:40pm. I am in a classroom full of accountants and professional tax preparers. An IRS agent is two seats down.

I picked up my espresso machine and my carafe flew across the kitchen. It shattered on the floor.

I spent the next three hours searching for a replacement carafe.

Wal-Mart didn’t have it. Neither did Kohl’s, Williams & Sonoma, Macy’s, Sears, or Target. Some store sales people actually laughed at me when I asked if they sold replacements. I felt dejected.

And then finally:

I remember staring at the stacks from the Hanson Hall starbucks during my 1L mid-day study sessions.

Now that I’m a 3L and done with law school classes, I only get to see the stacks from a distance.

Discovering that the cafeteria had 32oz. cups was probably a bad thing for my diet.

One of my neighbors was snowed in at work, so I agreed to walk his puppy.

Peppito growled at me and refused to leave the kennel. It took three trips and the lure of dog biscuits to get him out.

I was horrified when I first saw the demolition of Salem English Lutheran Church, but then I learned that the wrecking balls are only for the newish addition.

I work full-time at the office, clerk at the public defender’s office, volunteer at a tax non-profit, and regularly skip over to the law school for the tax law clinic.

I do 60-hours of work in three different counties, but life is so much easier and less stressful than having the regular law school schedule.

This semester I have 6 credits: the tax law clinic and a foreign-language movie class that meets 1 day a week. No law school classes or finals. BUMP!